Hot Topics BlogWednesday, March 22 2023

If you are an employee in Washington state, you may be wondering what are the leave of absence rules that apply to your situation. A leave of absence is an absence from work mutually and voluntarily agreed upon by you and your employer or a collective bargaining agent, or leave to which you are entitled under federal or state law, where the employer-employee relationship is continued and you will be reinstated in the same or similar job when the leave expires. There are different types of leave that may be available to you depending on your circumstances, such as: - Vacation Leave: In Washington, employers are not required to provide employees with vacation benefits, either paid or unpaid. However, if an employer chooses to do so, it must comply with its own established policy or employment contract. Employees in Washington who use this paid leave may receive up to 90% of their weekly wages or up to $1,000 per week. Qualifying events can include: birth or placement of a new child into a family, recovery from a serious illness or injury, treatment of a chronic health condition, These are some of the main types of leave that may be available to you as an employee in Washington state. However, there may be other types of leave that apply depending on your specific situation. You should always check with your employer about their policies and procedures regarding leaves of absence before taking any action. You should also consult a legal professional if you have any questions about your rights and obligations under federal and state laws. Wednesday, March 22 2023

If you're wondering why your health insurance premiums are increasing next year, you're not alone. Many Americans are facing higher costs for their coverage in 2023, and there are several reasons behind this trend. One of the main factors that affect health insurance prices is the cost of medical care. According to a report by Health Care Cost Institute, health care spending per person grew by 4.2% in 2019, the highest rate since 2014. This was driven by higher prices for hospital services, physician services, and prescription drugs. Another factor that influences health insurance prices is the demand for health care services. The COVID-19 pandemic has had a significant impact on how people use health care, both during and after the crisis. Some people may have delayed or avoided preventive care or elective procedures due to fear of exposure or lack of access. Others may have experienced long-term health complications from COVID-19 that require ongoing treatment. These changes in utilization patterns can affect how insurers estimate their risk and set their premiums. A third factor that affects health insurance prices is the availability of subsidies and tax credits. The American Rescue Plan Act (ARPA) of 2021 expanded eligibility and increased amounts for premium tax credits for people who buy health insurance through the Marketplace. This means that more people can qualify for financial assistance and pay lower premiums than before. However, this also means that insurers have to adjust their rates to account for the higher federal spending on subsidies. The impact of these factors on health insurance prices may vary depending on where you live, what type of plan you choose, and your income level. To get an estimate of how much you'll pay for health insurance in 2023, you can use tools like HealthCare.gov's plan preview or ValuePenguin's average cost calculator. You can also compare different plans and options to find one that meets your needs and budget. Sunday, November 06 2022

WA SB 5546 requires that all individual and insured medical plans cap member cost for insulin at $35 per month in 2023. This will impact plans as they are purchased or renewed in 2023. Prior to this change, insulin was capped at $100 per month instead. Great news for the many diabetics in Washington state! Monday, July 11 2022

Each year, small group insurance carriers in Washington state must submit their requested rate increases to Washington’s Office of the Insurance Commissioner (OIC). Small group insurance plans are for employers who had 50 or fewer employees on average during the calendar year prior to the effective (or renewal) date of the plan. Unfortunately, there are more two digit increases requested for 2023 than in 2022. Why? The pandemic. Many insurance companies are asking for higher rate increases on renewals due to lagging COVID-related claims, COVID test kits, a higher medical and prescription drug trend, and overall inflation. Additional factors impacting small group rates include:

There are two insurance companies who asked for double digit increases to their small group, age-banded rates: Kaiser of WA (+10.2%) and Premera Blue Cross of WA (+11.5%). These increase requests are based upon each carrier's gain or loss at the end of 2021. Kaiser has a $10.3M deficit and Premera's was $1.6M. It will take a few months for the OIC to review and approve the requested increases, but if you're with Kaiser of WA or Premera for small group, it may be time to shop around. Need help? Contact us. We can help find alternative affordable plans. Tuesday, February 01 2022

A quick update on the WA Cares LTC Act. On 1/27/2022, Governor Jay Inslee signed into law two bills, House Bill 1732 and House Bill 1733, which became effective at signing. These new bills will delay and make significant changes to the Washington Cares Fund. Employers should cease collecting premiums for the Washington Cares Fund immediately and refund any premiums that have been deducted in accordance with HB 1732 which requires refunds to be made within 120 days of the collection of the premiums. Employers should continue to monitor the WA Cares Fund for further developments at the following link: https://wacaresfund.wa.gov/. We will continue to provide updates on our website's blog located at https://pnwisol.com/hot-topics1. Wednesday, December 22 2021

On Friday, December 17, 2021, Governor Inslee, as well as Senate Majority Leader Andy Billig and House Speaker Laurie Jinkins, issued statements implementing a delay in the WA Cares program. Specifically:

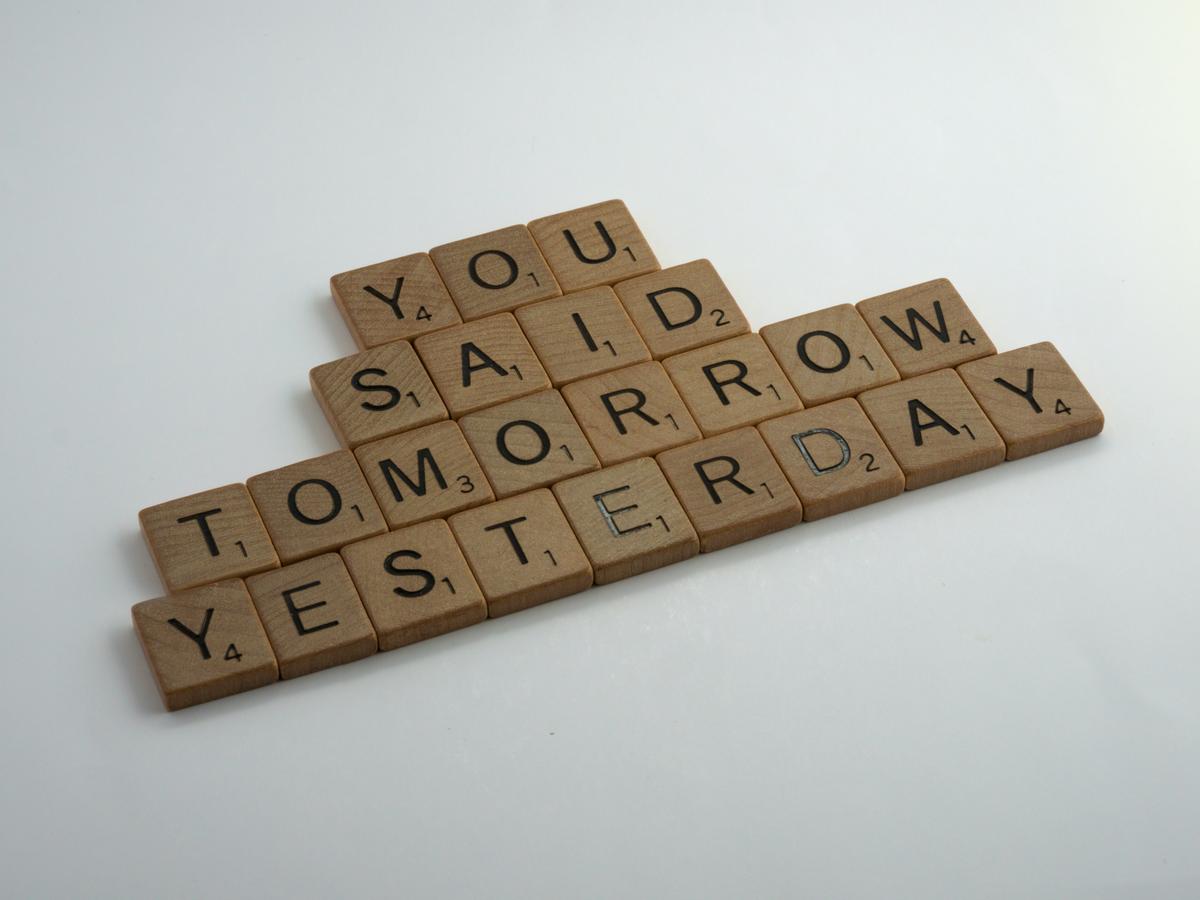

Photo by Brett Jordan on Unsplash Thursday, November 11 2021

FINALLY! The Internal Revenue Service (IRS) finally announced the official 2022 Flexible Spending Account (FSA), commuter, and adoption limits. Here are the newly released contribution limits: NEW CONTRIBUTION LIMITS

YOUR FLEXIBLE SPENDING ACCOUNTS The 2022 Dependent Care FSA contribution limits decreased from $10,500 in 2021 for families and $5,250 for married taxpayers filing separately. The 2021 Dependent Care FSA limits came in response to the COVID-19 pandemic as a temporary relief to working parents. Both healthcare FSAs and Dependent Care FSAs are versatile healthcare savings vehicles that allow individuals to receive tax benefits when they spend funds on eligible expenses. Overall, there are four general types of FSAs to know about:

WHAT TO KNOW ABOUT ROLLOVER FUNDS

Employers can offer one of these options but not both, and neither option is required. To learn more contact us for more information. DETAILS ON COMMUTER LIMITS If this plan is offered by the Employer, a commuter account allows you to set aside pre-tax funds to pay for your commute to work. For 2022, if you were to use both transit and parking, you could set aside up to $6,720 annually. Assuming a 30% effective tax rate that means you could potentially reduce your tax liability by more than $2,000.

Monday, November 08 2021

401(k) Contribution Limit Increased to $20,500 The Internal Revenue Service (IRS) has released Notice 2021-61, which contains cost-of-living adjustments for 2022 that affect amounts employees can contribute to 401(k) plans and individual retirement accounts (IRAs). The employee contribution limit for 401(k) plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. Other key limit increases include the following: The employee contribution limit for SIMPLE IRAs and SIMPLE 401(k) plans is increased to $14,000, up from $13,500. Key limits that remain unchanged include the employee contribution limit for IRAs (remaining at $6,000) and the catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans and the federal government’s Thrift Savings Plan (remaining at $6,500). Monday, October 04 2021

Starting Jan. 1, 2022, Washington state law protects you from surprise or balance billing if you receive emergency care at any medical facility or when you're treated at an in-network hospital or outpatient surgical facility by an out-of-network provider. What is surprise or balance billing The new Balance Billing Protection Act prevents people from getting a surprise medical bill when they receive emergency care from any hospital or if they have a scheduled procedure an in-network facility and receive care from an out-of-network provider. In this case, if an insurer and provider cannot agree on a price for the covered services, they go to arbitration and cannot bill the consumer for the amount in dispute. What to do if you get a surprise bill The law applies to most, but not all health plans Wednesday, March 17 2021

There are a number of new laws coming out of the Biden Administration which may impact you. Centers for Medicare & Medicaid Services (CMS) provided a fact sheet regarding new ACA subsidies, with a Q&A section to help individuals understand how to obtain the new subsidies. To delve further in by county, see the Assistant Secretary for Planning and Evaluation (ASPE) data sets which break down the uninsured numbers by household income, age, etc. Health and Human Services (HHS) provided a fact sheet regarding new ACA subsidies, along with a table which shows the number of uninsured who will now be eligible in each state. For additional information, refer to HR360 .

|

Terms & Conditions | Copyright | Privacy Policy

© PNW Insurance Solutions, LLC.